How Will Proposed Reconciliation Bill Impact Construction?

The “Inflation Reduction Act of 2022” includes several climate and transportation-related funding measures, with a […]

The “Inflation Reduction Act of 2022” includes several climate and transportation-related funding measures, with a series of proposed grants and tax credits aimed at alternative vehicle purchases and environmental review processes for infrastructure.

U.S. Senator Joe Manchin (D-WV) and Senate Majority Leader Chuck Schumer (D-NY) reached an agreement to vote on the Inflation Reduction Act of 2022. Senator Manchin says that Inflation Reduction Act of 2022 will address record inflation by paying down our national debt, lowering energy costs and lowering healthcare costs.

The Inflation Reduction Act of 2022, which aims to fight climate change and address record inflation, also includes policies that will invest in U.S. energy production,

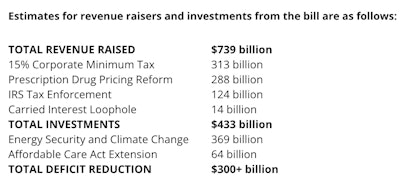

proposes to invest $369 billion of those funds in energy and climate change-related measures along with $64 billion to extend Affordable Care Act premium subsidies. An estimated $300 billion of the measure’s funding would go towards federal deficit reduction.

According to AASHTO, key elements of the bill of interest to state departments of transportation starts on page 699 of the proposed bill text:

- Section 60501: Neighborhood Access and Equity Grant Program. The entire program receives $3 billion for its various initiatives. It provides $1.893 billion at 80 percent federal share to “improve walkability, safety, and affordable transportation access through construction of projects that are context-sensitive” including removal of facilities similar to the Reconnecting Communities Pilot Program within the $1.2 trillion Infrastructure Investment and Jobs Act or IIJA enacted in November 2021. It also provides $1.11 billion at 100 percent federal share for similar activities as above, but specifically to economically disadvantaged communities with a community benefits agreement, anti-displacement policy, and local hiring plan, along with $42 million for technical assistance from the Federal Highway Administration. A key factor in this section is that funding cannot be used for “a project for additional through travel lanes for single-occupant passenger vehicles.”

- Section 60506: Low-carbon Transportation Materials Grants. Provides $2 billion “to reimburse or provide incentives to eligible recipients for the use of low-embodied carbon construction materials and products in projects,” including FHWA administrative expenses. FHWA may also reimburse non-federal partners for the increased incremental cost of using low-carbon material relative to traditional materials as well as provide an incentive payment of two percent of the cost of using low-carbon materials. However, the reimbursement or incentive cannot cause the federal share to exceed 100 percent and, again, disallows funding for “projects that result in additional through travel lanes for single occupant passenger vehicles.”

Several sections of the proposed bill also bump up fiscal support for alternative vehicles, such as:

- Section 13401: Clean Vehicle Credit (Page 366)

- Section 40007: Alternative Fuel and Low-emission Aviation Technology Program (Page 566)

- Section 60101: Clean Heavy-duty Vehicles (Page 650)

- Section 60102: Grants to Reduce Air Pollution at Ports (Page 653)

Comprehensive Permitting Reform Also Included

The legislation to fund climate, tax and health care reforms would also provide funds to several federal agencies to facilitate “efficient, accurate and timely reviews” for the environmental permitting process.

The fact sheet says: “The agreement calls for comprehensive Permitting reform legislation to be passed before the end of the fiscal year. Permitting reform is essential to unlocking domestic energy and transmission projects, which will lower costs for consumers and help us meet our long-term emissions goals.”

Section 60505: Environmental Review Implementation Funds. Provides $100 million “for the purpose of facilitating the development and review of documents for the environmental review process for proposed projects” such as guidance, technical assistance, templates, training, or tools to facilitate an efficient and effective environmental review process for surface transportation projects. That includes any FHWA administrative expenses to conduct such activities. That funding also aims to build capacity of eligible entities and facilitate the environmental review process for proposed projects, including administrative expenses.

The bill would advance in the Senate via the reconciliation process, which only requires 50 votes. This means it could pass without Republican support. As a part of the agreement, Democratic leaders in Congress and President Joe Biden also agreed to consider separate comprehensive permitting legislation this fall. Details of that permitting legislation have not been released.

Funds to support the environmental review process in the Inflation Reduction Act have the potential to lead to faster infrastructure project approvals. A separate permitting reform bill could also be impactful, depending on its scope, and would need Republican support to move forward.

Will the Bill Help Inflation?

With prices rising, contractors are facing extreme challenges in bidding out work for the longterm projects and there is skepticism on if this legislation will really help. According to estimates from the Penn Wharton Budget Model, the act would cause inflation to “very slightly” rise until 2024 then slide after that. Overall, the researchers said in the report Friday, there’s “low confidence that the legislation will have any impact on inflation.”

Penn Wharton estimates the bill would reduce the budget deficit by $248 billion over 10 years, less than the $300 billion estimate provided by Senate Democrats. An official score by the CBO is not yet available.

The bill as currently proposed will first be reviewed the Senate’s parliamentarian to conform with budget reconciliation legislation requirements – the so-called “Byrd Rule,” named after the late Sen. Robert Byrd (D-WV) – and could be voted on by the Senate next week, with the House following suit shortly thereafter. It’s unclear if the bill has support from all 50 Senate Democrats. Action on separate permitting legislation is not expected until September.